Secondaries

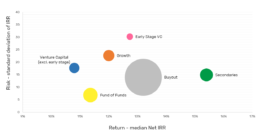

Valued at $72 billion at the end of 2018, secondaries are less volatile and tend to have better returns than general private equity, with median IRR of more than 15% and less than 2% of secondary funds losing money.

• Market more than tripled in less than 10 years

• Pricing much more attractive in small niches

• Small deals ($10–100m) produce higher returns, 1.8 - 2.2x MOIC vs market 1.4 - 1.6x

• Increasing interest in GP-led transactions

• GP restructuring expected to grow from 30% to 50% in next 5 years

Sources: Preqin, Evercore, Setter Capital